Are you looking for a credit card that rewards you for everyday purchases and travel expenses? The Chase Sapphire Preferred Credit Card is one of the best travel credit cards, offering generous rewards, flexible redemption options, and valuable travel perks. With a reasonable $95 annual fee and no foreign transaction fees, this card is a top choice for frequent travelers and anyone looking to maximize their credit card rewards.

Whether you’re a seasoned traveler or just starting to explore the world, this card has something to offer you. With its NEW generous sign-up bonus of 100,000 points and an extensive list of perks, the Chase Sapphire Preferred card is a smart choice for anyone looking to save money on travel expenses or simply earn rewards on their everyday purchases.

Affiliate Disclosure: Some of the links in this post may be affiliate links, which means I may earn a commission if you click through and make a purchase, at no additional cost to you. I only recommend products and services I use and love. As always, all opinions are my own.

Chase Sapphire Preferred 100,000 points sign-up bonus

One of the most significant selling points of the Chase Sapphire Preferred Credit Card is its impressive sign-up bonus. New cardholders can earn 100,000 points after spending $5,000 in the first three months of card membership. This bonus alone is worth at least $2,000 in travel rewards when transferred to travel partners such as Hyatt, United and Southwest.

Looking to redeem Chase Ultimate Rewards for hotel stays? Check out our guide on booking Hyatt hotels with points to maximize your redemptions. Read more about booking stays at Hyatt Hotels with points and transferring Chase Ultimate Rewards to the World of Hyatt Program.

Chase Sapphire Preferred

You can earn a signup BONUS of 60,000 Ultimate Rewards Points when you sign up for the Chase Sapphire Preferred Credit Card and spend $5,000 in the first three months of card membership. This bonus alone is worth at least $1,200 in travel rewards when transferred to travel partners such as Hyatt!

REWARDS RATE

1x-5x

BONUS VALUE

$1,200

SIGN-UP BONUS

60,000 points

ANNUAL FEE

$95

Note: if you were to use our referral link, please copy and paste it into another browser; thank you so much!

Chase Sapphire Preferred Annual fee

Is the Chase Sapphire Preferred worth the $95 Annual Fee? Absolutely! The Chase Sapphire Preferred benefits easily outweigh the annual fee. Cardholders enjoy premium travel perks, high earning rates on popular spending categories, and access to Chase Ultimate Rewards, one of the most valuable credit card rewards programs.

The $95 annual fee of which is easily covered by the DashPass alone ($120 annually) or primary car rental insurance. Plus, with no foreign transaction fees, this card is an excellent choice for international travelers.

Chase Sapphire Preferred earning rate

The Chase Sapphire Preferred travel rewards structure makes it easy to earn points on everyday purchases.

Chase Sapphire Preferred Credit Card at a glance

🏝 – 5x points on travel purchased through the Chase Ultimate Rewards portal

🚗 – 5x points on Lyft rides

🍔 – 3x points for dining out

🍿 – 3x points on select streaming services and online grocery purchases

✈️ – 2x points on all other travel purchases, from airfare and hotels to taxis and trains

🛒 – 1x for everything else

In addition to the sign-up bonus, the Chase Sapphire Preferred card offers a generous earning rate that allows cardholders to rack up points quickly. With this card, you can earn rewards on a wide variety of purchases, including:

- 5x points on travel purchased through the Chase Ultimate Rewards portal: When you book your trip through the Chase Ultimate Rewards portal, you’ll earn 5 points for every dollar spent. This includes flights, hotels, car rentals, and more.

- 5x points on Lyft rides: As a cardholder, you’ll earn 5 points for every dollar spent on Lyft rides. This is a great way to earn rewards on your everyday transportation expenses.

- 3x points for dining out: When you dine out at restaurants, you’ll earn 3 points for every dollar spent. This includes everything from fast food to fine dining.

- 3x points on select streaming services and online grocery purchases: You’ll earn 3 points for every dollar spent on select streaming services and online grocery purchases. This is a great way to earn rewards on your everyday expenses.

- 2x points on all other travel purchases: From airfare and hotels to taxis and trains, you’ll earn 2 points for every dollar spent on all other travel purchases.

- 1x for everything else: For all other purchases, you’ll earn 1 point for every dollar spent.

Whether you’re traveling, dining out, or simply making everyday purchases, this card has you covered.

Chase Sapphire Preferred benefits

In addition to the rewards and earning rate, the Chase Sapphire Preferred card offers a number of valuable benefits that can save cardholders money and make their travels more enjoyable. Some of these benefits include:

1. 1:1 points transfer to Chase Sapphire Preferred travel partners

Maximize your rewards by transferring your Ultimate Rewards points to Chase travel partners like World of Hyatt, Marriott Bonvoy, United MileagePlus, Southwest Rapid Rewards, and more. This allows you to stretch your points even further, especially for hotel stays and premium flights.

💡 Good to know

You can read how we booked our stay by redeeming Hyatt Points at:

- Alila Ventana Big Sur, 45,000 Hyatt (Chase Ultimate Rewards) points per night

- Park Hyatt Kyoto, Japan, 35-45,000 Hyatt (Chase Ultimate Rewards) points per night

- Andaz Maui at Wailea, Hawaii, 35-45,000 Hyatt (Chase Ultimate Rewards) points per night

To learn more, you can read our article about maximizing credit card rewards: cashback vs transferring to travel partners.

2. Chase Ultimate Rewards travel portal

When redeeming points through the Chase Ultimate Rewards travel portal, you get 25% more value (e.g., 60,000 points = $750 in travel). This feature provides a flexible and valuable redemption option for those who don’t want to deal with transferring points, while we definitely recommend to transfer your points to transfer parnters for a better deal!

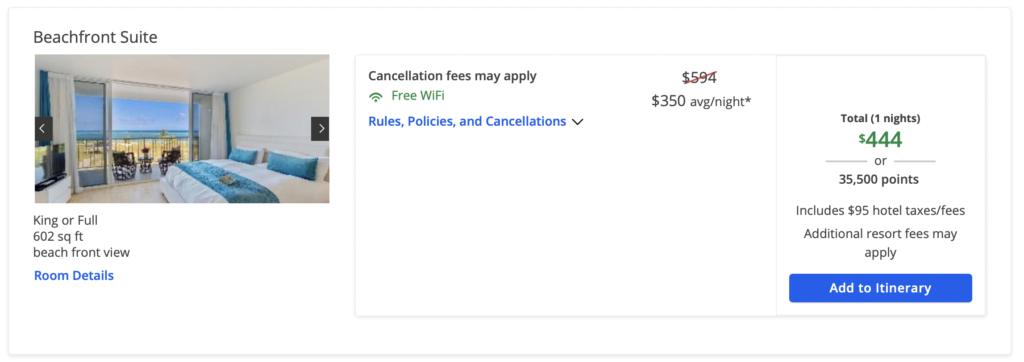

For example, on the screenshot above, you need to spend 25% fewer points (35,500 vs 44,400) to redeem them for the night at this hotel.

Keep in mind that transferring your points to travel partners can often offer more value, so it’s worth comparing your options before making a decision.

3. Primary rental car insurance

One of the great travel benefits of the Chase Sapphire Preferred Card is its primary car rental insurance. This benefit allows you to decline the expensive collision damage waiver (CDW) insurance offered by car rental companies and instead charge the rental cost to your card. If the rental car is damaged or stolen, you can then file a claim with Chase for reimbursement, subject to the terms and conditions of the benefit. This can save you a lot of money on your car rental, as CDW insurance can be pretty expensive.

It’s worth noting that this benefit is only available for rentals made with your card and does not cover rentals made with rewards points or with an offer of free or discounted rental. However, it’s still a valuable benefit that can provide peace of mind and save you money on your travels.

4. Trip delay and cancellation insurance

The trip delay and cancellation insurance helps cover expenses if your trip is delayed, canceled, or interrupted due to weather, illness, or other covered reasons.

5. Travel and emergency assistance services

This benefit provides cardholders with 24/7 access to a team of experts who can help with everything from booking flights to finding a doctor overseas.

6. Complimentary DashPass

As a cardholder, you’ll receive a complimentary DashPass membership (worth $120 annually), which provides discounted or free delivery on eligible orders from select restaurants through the DoorDash app.

7. Anniversary points boost

Every year, you receive an anniversary bonus equal to 10% of your total purchases made in the previous year, helping you earn even more rewards.

8. No foreign transaction fees

The Chase Sapphire Preferred is great for international travel because it has zero foreign transaction fees, allowing you to use your card worldwide without extra charges.

9. $50 in annual statement credits

As a cardholder, you can earn up to $50 in statement credits each account anniversary year for hotel stays purchased through the Chase Ultimate Rewards portal. This is a great way to save money on your travels and get even more value out of your card. Simply book your hotel stays through the portal, and you’ll automatically receive the statement credits on your account.

How to apply for the Chase Sapphire Preferred Card

Applying for the Chase Sapphire Preferred is simple, but you must meet certain requirements:

- Good to Excellent Credit Score (700+ recommended)

- Chase 5/24 Rule: You may not be approved if you’ve opened five or more credit cards in the past 24 months

- Stable Income: Applicants must provide financial details, including employment and income information

If approved, your card will be mailed within a few days, allowing you to start earning rewards immediately.

Applying for the Chase Sapphire Preferred card is easy and can be done online, and the card will be mailed to the applicant within a few days if approved.

Chase Sapphire Preferred

You can earn a signup BONUS of 60,000 Ultimate Rewards Points when you sign up for the Chase Sapphire Preferred Credit Card and spend $5,000 in the first three months of card membership. This bonus alone is worth at least $1,200 in travel rewards when transferred to travel partners such as Hyatt!

REWARDS RATE

1x-5x

BONUS VALUE

$1,200

SIGN-UP BONUS

60,000 points

ANNUAL FEE

$95

Bottom line

The Chase Sapphire Preferred Credit Card remains one of the best travel rewards credit cards in 2025. With a generous sign-up bonus, high earning rates, valuable travel perks, and flexible redemption options, this card is a great choice for anyone who wants to earn rewards on everyday spending and travel purchases.

Whether you’re booking flights, dining out, or shopping for groceries, the Chase Sapphire Preferred offers exceptional value and savings, making it a must-have for travelers and rewards enthusiasts alike.

Ready to apply? Get started today and start earning Chase Ultimate Rewards points for your next adventure!

Non-affiliate disclosure: all information about the this card have been collected independently by On Points With Kids and has not been reviewed by the issuer.