The Capital One Venture X is one of the top premium travel rewards cards available today. With a lucrative 75,000 mile welcome bonus and stellar earning rates on Capital One Travel purchases, this card aims to be the go-to for frequent travelers. The question is it really worth the $395 annual fee? Let’s take a look at all the benefits Capital One Venture X offers and find out.

Sign-up bonus

New cardholders can earn 75,000 Capital One miles after spending $4,000 within the first 3 months. While Capital One has offered up to 100k miles for this card in the past, this 75k bonus is still extremely valuable and worth around $1,200 in travel based on our valuation of Capital One miles.

Let’s put that in perspective and see what 75,000 miles is enough to cover:

1. You could book 3-4 domestic roundtrip flights.

2. You can score several free nights at mid-tier hotels through Capital One’s travel portal.

3. If transferred to airline partners, you could book an international business-class flight to Europe (top transfer partners include Air Canada Aeroplan, Avianca LifeMiles).

Capital One Venture X

The Capital One Venture X card offers valuable rewards for travelers, including a 75,000 mile welcome bonus and premium travel benefits. With luxury perks like airport lounge access, statement credits, and anniversary miles bonuses, this metal credit card can elevate your next vacation.

REWARDS RATE

2x-10x

BONUS VALUE

$1,200

SIGN-UP BONUS

75,000 miles

ANNUAL FEE

$395

Earning rate

Capital One Venture X credit card at a glance

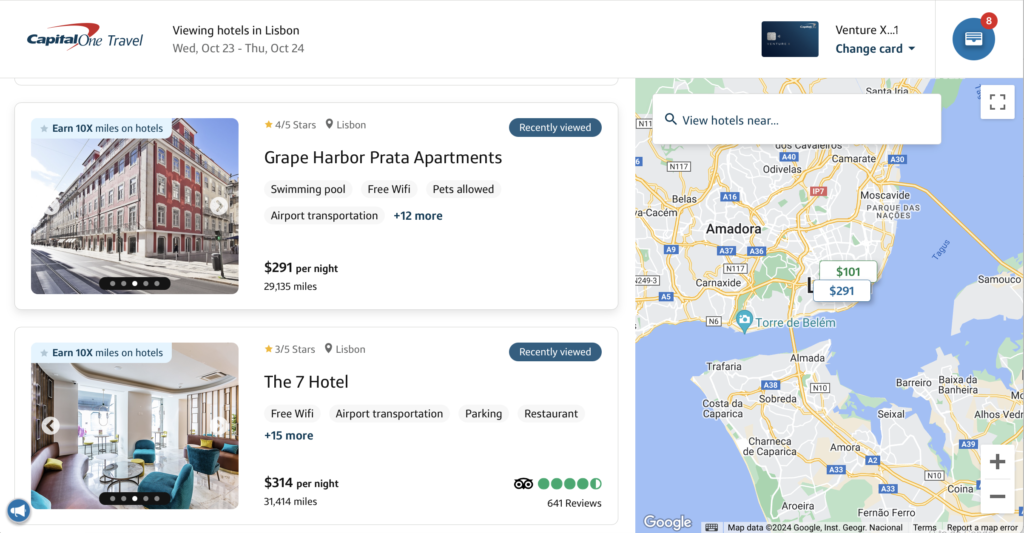

🏨 – 10x miles on hotels and rental cars booked through Capital One Travel

✈️ – 5x miles on flights booked through Capital One Travel

🛒 – 2x miles on all other purchases

In addition, cardholders receive 10,000 anniversary bonus miles each year at card renewal. There’s no spending requirement to earn this anniversary perk.

Between the 10x and 5x categories and the annual bonus, it’s easy to rack up Capital One miles quickly with the Venture X. The 2x rate on other purchases is strong as well, beating many other travel cards.

Redeeming miles

Capital One miles can be redeemed in a few different ways:

- Transfer to airline/hotel partners at a 1:1 ratio

- Book travel through Capital One portal at 1 cent per mile

- Redeem for statement credits at 0.5 cents per mile

Based on the transfer options, we value Capital One miles at approximately 1.6 cents each. This means the 75,000 mile welcome bonus is worth around $1,200 in travel. Top transfer partners include Air Canada Aeroplan, Avianca LifeMiles, and Wyndham Rewards.

If you redeem miles directly through Capital One’s travel portal, they are worth 1 cent each. While less than transferring, the portal offers significant flexibility and ease of use. Statement credits offer the lowest value at just 0.5 cents per mile.

Benefits

In addition to the rewards and earning rate, the Capital One Venture X card offers a number of valuable benefits that can save cardholders money and make their travels more enjoyable. Some of these benefits include:

$300 annual travel credit

Cardholders receive up to $300 in travel credits each year for purchases made through Capital One Travel. This credit effectively reduces the annual fee to $95.

The Capital One Venture X Rewards Credit Card makes using your $300 annual travel credit simple. Just book your travel – flights, hotels, rental cars – at capitalonetravel.com and pay with your Venture X card. You can either make a single $300+ purchase or make multiple smaller purchases over time, receiving credits until reaching $300 total in a card membership year.

Authorized user lounge access

Both primary cardholders and authorized users get complimentary access to Capital One Lounges, Priority Pass, and Plaza Premium Lounges — a collection of over 1,300 airport lounges worldwide. Each member can bring up to two guests for free. With authorized users also receiving lounge access, this is an incredibly generous perk.

Global Entry/TSA PreCheck credit

Get reimbursed up to $100 in statement credits for a Global Entry or TSA PreCheck application fee every 4-4.5 years. This perk saves time at airport security lines and makes traveling more seamless. Make sure to read our post about everything you need to know about getting Global Entry with kids.

Primary rental car insurance

When booking rental cars on your Venture X card, you get primary coverage protection. This means you can decline the rental company’s collision insurance and be covered in case of theft or damage.

This perk alone can save hundreds of dollars in rental fees.

Cell phone protection

Cardholders are covered against damage or theft when paying their monthly cell bill with the Venture X card, up to $800 per claim (2 claims annually). There’s a $50 deductible per claim. This provides peace of mind for your beloved devices.

No foreign transaction fees

Aside from the benefits above, the Venture X charges no foreign transaction fees. This makes it an excellent card for international trips.

Annual fee

Considering the premium features, it’s unsurprising that this card commands a $395 annual fee. Although steep, the annual credits and anniversary miles offset the majority of this cost, reducing the effective annual fee to approximately $95.

Furthermore, factoring in the 10,000 bonus miles you receive each year, the card becomes net-positive (assuming the base value of Capital One Miles is 1 cent per point). Essentially, Capital One would effectively pay you $5 annually to keep the card open!

For frequent travelers who can maximize the Capital One Travel credits, annual bonus miles and lounge access perks, the Venture X provides luxury travel rewards well beyond its annual fee.

Application

Applying for the Capital One Venture X card is easy and can be done online. To be eligible for this card, applicants must have a good to excellent credit score (generally considered to be 700 or higher).

💡 Good to Know

It’s important to note that Capital One has recently implemented a new rule: existing or previous cardmembers are not eligible for this product if you have received a new cardmember bonus for this product in the past 48 months.

In addition to a good credit score, applicants must provide personal and financial information, including their employment and income details. The card will be mailed to the applicant within a few days if approved.

Bottom line

The Capital One Venture X card is a superb option for travelers looking to earn rewards fast on hotels, rental cars, and flights. Between Capital One’s improved loyalty program and the card’s upscale benefits, it’s easy to get well over $395 in value each cardmember year. If you frequently book travel and can take advantage of the annual credits, the Venture X should be strongly considered.

Non-affiliate disclosure: all information about the this card have been collected independently by On Points With Kids and has not been reviewed by the issuer.