For small business owners seeking a credit card that offers substantial rewards and premium benefits, the Chase Ink Business Preferred should be on your radar. This comprehensive review will explore the card’s features, helping you decide if it’s the right fit for your business needs. Don’t miss the current elevated sign-up bonus!

Chase Ink Business Preferred Sign-up bonus

Chase is currently offering an exceptional sign-up bonus for the Chase Ink Business Preferred card. New cardholders can earn 90,000 Ultimate Rewards (UR) points after spending $8,000 within the first three months of account opening. With UR points valued at approximately 2 cents each when transferred to travel partners, this bonus could be worth an impressive $1,800 or more!

Chase Ink Business Preferred

You can earn a massive signup bonus of 90,000 Ultimate Rewards points when you get the Chase Ink Business Preferred card and spend $8,000 within the first three months. This valuable bonus is worth around $900 in cash back or $1,800 in travel when you redeem through Chase or transfer points to airline and hotel partners.

REWARDS RATE

1x-3x

BONUS VALUE

$1,800

SIGN-UP BONUS

90,000 points

ANNUAL FEE

$95

Chase Ink Business Preferred Annual fee

The Chase Ink Business Preferred has a $95 annual fee. Given its robust rewards structure and benefits, this fee can be easily offset.

Earning rate of Chase Ink Business Preferred

Earning rate of the Chase Ink Business Preferred boasts a rewarding point structure:

Chase Ink Business Preferred credit card at a glance

🚗 – 5x points on Lyft rides

✈️ – 3x points on travel purchases, from airfare and hotels to taxis and trains

📦 – 3x points on shipping purchases

📱 – 3x points on internet, cable, and phone services

📰 – 3x points on advertising purchases with social media sites and search engines

🛒 – 1x points on all other purchases

This earning structure allows businesses to maximize rewards in common expense categories, potentially earning up to 450,000 points annually from the 3x categories alone.

Benefits of Chase Ink Business Preferred

In addition to the rewards and earning rate, the Chase Ink Business Preferred card offers a number of valuable benefits that can save cardholders money and make their travels more enjoyable. Some of these benefits include:

1. 1:1 points transfer to travel partners

💡Good to know

It’s important to note that you can transfer Chase Ultimate Rewards to transfer partners only if you have one of these premium credit cards: Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Preferred.

In other words, you don’t need to have the Chase Sapphire Preferred first (for example, as it is usually referred to as a first travel credit card) in order to transfer your Ultimate Rewards to transfer partners when you have the Chase Ink Business Preferred card!

As a Chase Ink Preferred cardholder, you can transfer your points to various travel partners (such as Hyatt, United Airlines, and Southwest Airlines) at a 1:1 ratio. This means you can get even more value from your points by redeeming them for flights and hotel stays.

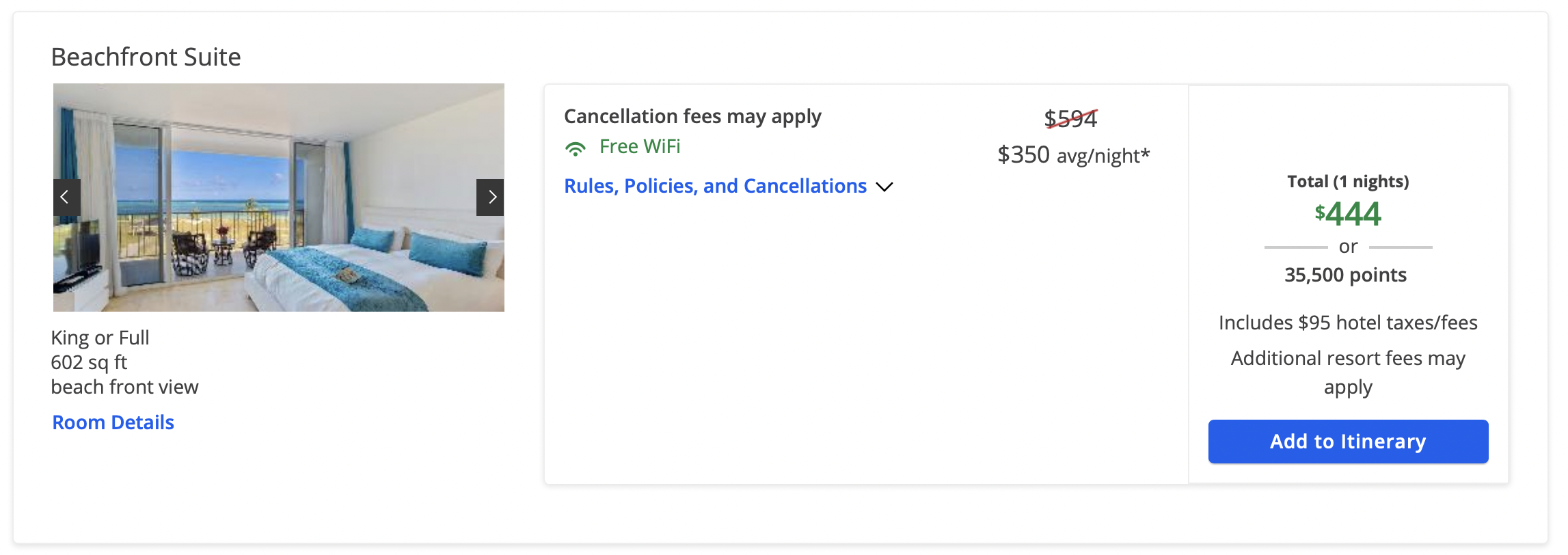

2. 25% more redemption value

If you choose to redeem your points through the Chase Ultimate Rewards travel portal, you will receive 25% more value, not at just a 1:1 ratio.

For example, on the screenshot above, you need to spend 25% fewer points (35,500 vs 44,400) to redeem them for the night at this hotel.

But, as always, keep in mind that transferring your points to travel partners can often offer more value, so it’s worth comparing your options before making a decision.

3. Cell phone protection

Get up to $600 per claim (maximum of 3 claims per 12 months) against covered theft or damage for phones listed on your monthly bill when you pay it with your card.

4. Trip cancellation/interruption insurance

Receive reimbursement up to $5,000 per trip for pre-paid, non-refundable travel expenses if your trip is canceled or cut short by covered situations.

5. Primary rental car insurance

One of the great travel benefits of the Chase Ink Business Preferred Card is its primary car rental insurance. This benefit allows you to decline the expensive collision damage waiver (CDW) insurance offered by car rental companies and instead charge the rental cost to your card. If the rental car is damaged or stolen, you can then file a claim with Chase for reimbursement, subject to the terms and conditions of the benefit. This can save you a lot of money on your car rental, as CDW insurance can be pretty expensive.

It’s worth noting that this benefit is only available for rentals made with your card and does not cover rentals made with rewards points or with an offer of free or discounted rental. However, it’s still a valuable benefit that can provide peace of mind and save you money on your travels.

6. Purchase protection

Get coverage up to $10,000 per claim and $50,000 per account year against damage or theft for new purchases for 120 days.

7. No foreign transaction fees

The Chase Ink Business Preferred card has no foreign transaction fees, making it a great choice for international travel. You can use your card abroad without worrying about racking up additional fees on top of your purchases.

Applying for Chase Ink Business Preferred

Applying for the Chase Ink Business Preferred card is easy and can be done online. To be eligible for this card, applicants must have a good to excellent credit score (generally considered to be 700 or higher). It’s important to note that Chase has a 5/24 rule, which means that if you have opened five or more credit card accounts within the past 24 months, you may not be approved for this card. In addition to a good credit score, applicants must provide personal and financial information, including their income details. The card will be mailed to the applicant within a few days if approved.

Qualifying for a business card

You don’t need to run a large corporation to qualify for the Chase Ink Business Preferred. Small business owners, freelancers, and even those with side gigs can apply. As long as you have a profit-generating venture or potential for one, you may be eligible.

Qualifying for a business card without a traditional business

It’s a common misconception that you need to own a large, established business to qualify for a business credit card. In reality, the definition of a “business” for credit card purposes is quite broad. Here’s what you need to know:

Side hustles count

Even small, part-time ventures can qualify. This includes:

- Selling items on online marketplaces like eBay, Etsy, or Facebook Marketplace

- Freelancing or consulting work

- Tutoring or teaching online courses

- Driving for ride-sharing services

- Renting out a room on Airbnb

- Having a blog or a website

You don’t need to be profitable yet

Many card issuers understand that businesses take time to become profitable. You can often include projected future income on your application.

Sole proprietorship is fine

You don’t need a formal business structure. Most small business owners apply as sole proprietors, using their Social Security number instead of a business tax ID – no EIN required.

Use your personal credit

Business credit card applications typically rely on your personal credit score for approval.

Your name can be your business name

If you haven’t formally named your business, you can use your own name as the business name on the application.

Personal guarantee

Keep in mind that you’ll be personally responsible for the debt on the card, regardless of your business structure.

How to meet the $8,000 spending requirement

Here are some strategies to help you meet the $8,000 spending requirement in 3 months:

Pay estimated taxes (1040-ES)

If you’re self-employed or have significant non-wage income, you can pay your quarterly estimated taxes using your credit card. This can quickly help you meet a large portion of the spending requirement. Even if you’re not self-employed, you can still overpay taxes to meet the spending threshold and you’ll get the overpayment refunded when you file your tax return.

Pay property taxes

Many local governments accept credit card payments for property taxes. This can be an easy way to meet a significant portion of the spending requirement in one transaction.

Maximize everyday spending

Put all your regular business expenses on this card, including office supplies, inventory, and utilities.

Prepay expenses

Consider prepaying for services you know you’ll need, such as insurance premiums, or subscriptions.

Time large purchases

If you’re planning any significant business purchases, time them to fall within the first three months of card ownership.

Charitable donations

If your business makes charitable contributions, consider making them during this period using your new card.

Chase Ink Business Preferred

You can earn a massive signup bonus of 90,000 Ultimate Rewards points when you get the Chase Ink Business Preferred card and spend $8,000 within the first three months. This valuable bonus is worth around $900 in cash back or $1,800 in travel when you redeem through Chase or transfer points to airline and hotel partners.

REWARDS RATE

1x-3x

BONUS VALUE

$1,800

SIGN-UP BONUS

90,000 points

ANNUAL FEE

$95

Bottom line

The Chase Ink Business Preferred offers a compelling package for business owners, with its generous sign-up bonus, valuable ongoing rewards, and useful perks. If you can maximize the 3x categories and take advantage of the sign-up bonus, this card can provide significant value, easily justifying its annual fee.

You can use our referral link to sign up for the Chase Ink Business Preferred Credit Card.

Non-affiliate disclosure: all information about the this card have been collected independently by On Points With Kids and has not been reviewed by the issuer.